K-1 Cloud Report

Volume 1 — August 7, 2024

An overview of what we are developing at ScheduleK-1.com as of August 7, 2024.

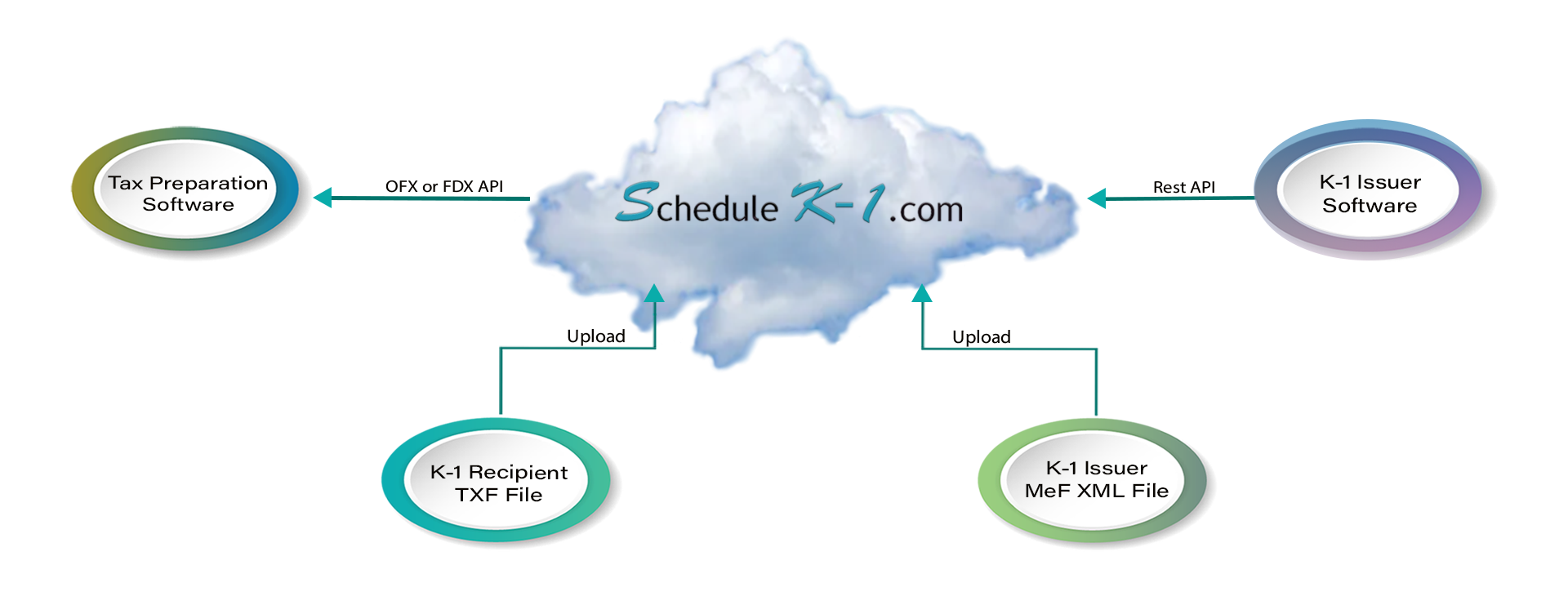

Pioneering End-to-End Intelligent K-1 Content Delivery

At ScheduleK-1.com we use the term Intelligent K-1 content to mean content containing structured data that is computer-readable. In general, Schedules K-1 are distributed in portable document format (PDF). PDFs are human-readable but not computer-readable. Yes, if you write complex PDF parsing and/or OCR code, your computer program might be able to accurately extract the K-1 data from the PDF. But the cost to develop such code is high and the accuracy is not guaranteed. It makes no sense for 1065 software to hold K-1 data in a structured form but fail to deliver the data in a structured format. Hence we are pioneering the production and delivery of truly digital K-1 content.

Industry-Standard Digital K-1 Content

The Financial Data Exchange (FDX) standard-setting organization has established a standard K-1 data structure for use by the tax industry. There are three ways the structured data can be delivered.

1. Industry-Standard JavaScript Object Notation (JSON) Files

A key ingredient in the recipe for improved tax prep experiences for investors in partnerships is the use of open, industry-standard data structures. And the use of JSON to represent those structures makes creation, transport, and consumption of the data a straight-forward process. At ScheduleK-1.com production of K-1 JSON files is a feature of all our products as seen in the table below.

2. Intelligent PDF Files

Schedule K-1 PDFs produced by ScheduleK-1.com are intelligent, meaning the data is shown on the visible PDF for human consumption and also included internally for computer consumption. More information about this technology is available at financialdataexchange.org and taxdataexchange.org.

3. Industry-Standard Application Program Interfaces (APIs)

The ScheduleK-1.com APIs both receive and deliver standard JSON content using the protocols established by the FDX organization. Contact us to establish an API relationship between your company and ScheduleK-1.com.

|

ScheduleK-1.com Products/Services |

Industry-Standard JSON Files |

Intelligent PDF Files |

Hosting for Import into Tax Software |

|---|---|---|---|

| App |  |

|

|

| API |  |

|

|

| Docker |  |

|

K-1 Import with Industry-Standard API

1040 tax software can retrieve and import K-1 data from our server using FDX standard protocols. Each K-1 is assigned a unique document ID and code. The software prompts the user for the information as seen here.

Import From ScheduleK-1.com

![]()

To import your K-1 information, enter your assigned tax document ID and tax document code. Your partnership will provide you these codes.

Tax Document ID

Document Code

Retrieval of the K-1 data involves issuing a straight-forward HTTP GET request as represented in the below CURL command.

curl --request GET \

--location "https://{apiGatewayAddress}/fdx/v5/tax-forms/1234567890123456" \

--header "Accept: application/json" \

--header "x-apikey: R3VgcNfo1kQTgLVR2123456778bAoyXuT9mxwlaGWw" \

--basic --user 1234567890123456:87654321

New Revenue Opportunities for 1065 Tax Software

1065 tax software can offer the production of digital K-1 data as JSON files, intelligent PDFs, and/or API importable content — as a supplemental product offering. By partnering with ScheduleK-1.com, 1065 tax software can leverage the ScheduleK-1.com APIs to generate the desired digital content. Alternatively, 1065 tax software can integrate the Docker images described below.

Turnkey Docker Images

Docker images are distributed through Google Artifact Registry. Download and deploy the image in your server ecosystem.

POST a 1065 MeF xml file to the service. A ZIP of JSON and/or Intelligent PDF files is returned.

A command line version is also available.

Join the Intelligent K-1 revolution.

Contact support@schedulek-1.com

to partner with ScheduleK-1.com today.

A Service of ITIPS

Internet Tax Information Processing Services, Inc